Health policy

← vista completaPublished on October 25, 2017 | http://doi.org/10.5867/medwave.2017.08.7054

Effectiveness of sugar-sweetened beverages taxes to reduce obesity: evidence brief for policy

Efectividad de los impuestos a bebidas azucaradas para reducir niveles de obesidad: resumen de evidencia para políticas

Abstract

The high prevalence of obesity in Chile, along with the increasing consumption of sugary drinks in the country, has made apparent the need to propose fiscal measures, through taxes on specific foods, as a complementary alternative to approach this problem. Since 2014, an additional 5% increase in the tax on sugar-sweetened nonalcoholic beverages has been in effect in Chile, an amount that may be insufficient to produce an impact on obesity levels.

The evidence of the effectiveness of fiscal measures upon sugary beverages, in terms of price modification, generally reflects a high transfer of the tax to the final consumers, which is variable according to local conditions. After the analysis of the literature, a sensitivity of the demand to the changes in prices of sugary drinks was evidenced, by means of negative elasticity close to -1, for different groups observed, besides a decrease in the consumption of these products. On the other hand, effects on body weight after the application of these taxes were analyzed by several simulation studies, reporting a decrease on prevalence of obesity between 0.99% and 2.4%. Within the acceptability of a fiscal measure of this nature, there were variable support figures between 36% and 60% among general population. Regarding possible negative effects on employment, an international study even evidenced a rise in the figures for employment in two locations following the application of a tax on sugary drinks.

The research showed that there is evidence to support the implementation of a fiscal measure upon sugary beverages in Chile; however, there is a lack of local simulation studies to explore the possible effects and implications of a new tax of this kind in the country. Taxation measures upon foods seem to be both viable and effective alternatives to address the problem of obesity in Chile, but they should be considered as part of an overall strategy with the clear goal of reducing the prevalence of national obesity.

Executive summary

Introduction: Chile has high rates of obesity (25.1%) [1],[2], with a rising trend and greater presence in sectors with lower educational levels. In addition, a high and increasing consumption of sugar- sweetened beverages (SSB) is evident in Chilean population, contributing to the increasing prevalence of obesity in population [3]. Fiscal measures, through taxes on specific foods, could play a complementary role to other measures traditionally implemented, discouraging the consumption of foods associated with weight excess. Among the latest fiscal measures implemented in Chile, an increase from 13% to 18% in the additional tax on non-alcoholic beverages was passed, which has been in force since 2014. Although there has been progress in this area, international evidence suggests that an increase of this magnitude would be insufficient to generate impact on population obesity prevalence. In this context, the question arises as to what is the evidence that supports this type of fiscal policies in terms of: (i) their effectiveness in modifying prices, demand; (ii) their effects on health.

Evidence of effectiveness of fiscal policies on sugar-sweetened beverages:

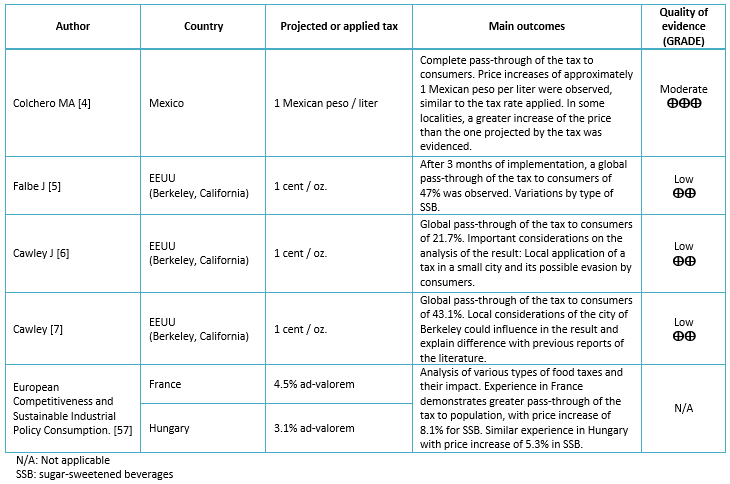

• Tax effects on price: a study in Mexican population evidenced a 100% pass-through of the tax to prices at the consumer level. Three studies carried out in Berkeley showed lower percentages of transfer (between 21.7% and 47%), although under local conditions that could explain these numbers [4],[5],[6],[7].

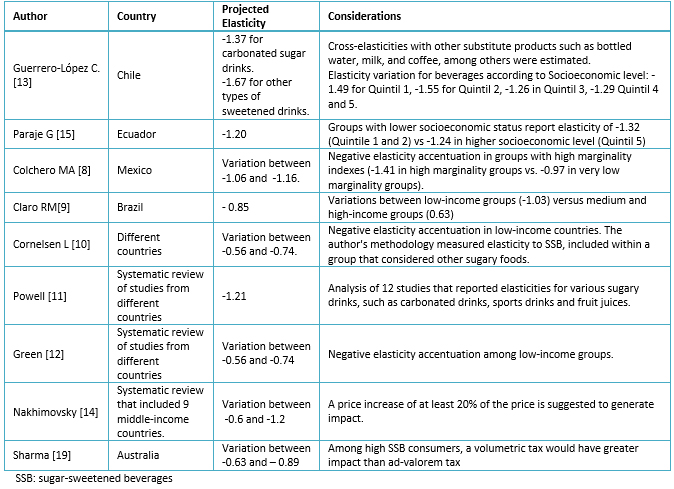

• Tax effects on the demand for sugar-sweetened beverages: consumption decreases when price rises. Four studies in Latin America, including Chile, showed negative elasticity close to -1, slightly higher than other findings in systematic reviews and meta-analysis of international literature [8],[9],[10],[11],[12],[13],[14],[15].

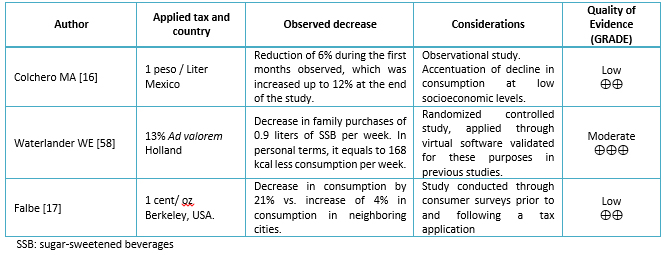

• Tax effects on consumption: a study carried out in Mexican population shows the variation in consumption of sugar-sweetened beverages after the application of one Mexican peso / liter tax. There was an average of 6% decrease in consumption, with a maximum reduction of 12% for the last month observed, with accentuated trends in low socioeconomic status households [16]. Another study performed in Berkeley also showed a post-tax effect, with a 21% decrease in consumption [17].

• Tax effects on body weight: eighteen modeling studies and two meta-analyses that account for this aspect were found. Main results show a greater effectiveness in volumetric tax (cents/liter) versus ad valorem tax, in order to generate impact on populations’ weight. Several studies that projected a tax of one US cent per liter of sugar-sweetened beverage reported results of decreasing prevalence of obesity, between 0.99% and 2.4%, with variations according to year of measurement and age group involved [2],[18],[19],[20],[21],[22],[23],[24],[25],[26],[27],[28],[29],[30],[31],[32],[33],[34].

Acceptability and implementation considerations

• Regarding the opinions of different stakeholders, nine studies reported evidence in this aspect. In general population, supporting levels to fiscal measures for sugar-sweetened beverages varied between ranges of 36% to 60% of acceptability. The evaluation of stakeholders’ opinions involved in health policies decision-making process was different, presenting slightly lower support to fiscal policy on sugary drinks, citing economic factors and potential government authority to interfere with personal freedoms [35],[36],[37],[38],[39],[40],[41],[42],[43]. A qualitative research carried out in Chile aimed to explore the political context towards the 5% tax increase on sugary drinks implemented in 2014. As an important argument against this measure, the lack of local effectiveness studies to support these policies was detected. In addition, the importance of globally addressing the obesity problem was identified [44].

• Related to the political process, two analyses about the design and application considerations of a tax on sugar-sweetened drinks were distinguished. Key factors in the success of this kind of measure were suggested, such as the type of tax to be applied, type of beverage to be taxed and its corresponding rate, in addition to conducting a thorough analysis of the local situation and understanding the prevalence of obesity, consumption of sugary drinks and taxes in force [45],[46].

• Two studies referred to possible negative effects associated with employment and substitution. A simulation performed by Powell, with a 20% tax on sugar-sweetened beverages applied in the states of Illinois and California, showed an increase in employment rates for both states of 0.06% and 0.03%, respectively [47].

• Considering the potential substitution of sugary beverages for other high-calorie products, one study explored the substitution of other foods with a tax measure of this kind, reporting a global decrease in the daily purchase of 24.3 kcal per person, with no evidence of substitution for other sugary foods [48].

Conclusions: The literature research showed evidence that the demand for sugar-sweetened drinks is elastic to price changes and that taxes are passed through on to consumers' prices. It stands out the Mexican experience of a tax of one Mexican peso / liter, which reported a global decline in consumption, accentuated in population with lower socioeconomic level. Studies that evaluated impact on body weight largely coincided with modeling studies, demonstrating that a rise over a 10% of the price of a product would have a positive impact on health. It is important to mention that the recent tax reform in Chile, which generated a 5% price increase in sugar-sweetened beverages, may be insufficient to generate behavioral changes that lead to health effects.

Design and implementation considerations of a tax measure are diverse. Chile evidences conditions that position it as a country that could benefit from the implementation of a measure of this nature. In view of the possible application of a policy to sugar-sweetened beverages in Chile, local considerations and the nature of the tax measure should be made public in order to properly inform the general population, decision-makers and industry. It is also essential to generate more local studies to explore the effects and implications of a new tax on sugary drinks, in order to complement the international experience with national evidence. Food tax measures to address population obesity problems seem to be viable and effective alternatives, but should be considered as part of a strategy and not a solution by itself, and should be embedded within a national program that addresses the global approach of the problem.

Introduction

High levels of obesity prevalence represent a priority public health problem in Chile, given its important association with chronic noncommunicable diseases, its associated morbidity and mortality, the burden of disease associated with them and the economic cost of its treatment.

Obesity rates in Chile are not encouraging. They show a rising tendency, with a current prevalence of 25.1% in general population, according to the latest National Health Survey [1]. At lower educational levels, this rate increases to 35.5%. Successive measurements over the past few years reveal a steady increase in this prevalence across all age groups. The National Health Survey of 2003 showed a prevalence of general obesity of 23.2%, versus one of 25.1% in 2009 [49].

Sugar-sweetened beverages (SSB) are products of wide availability and consumption in our population. Its intake is strongly associated with increased likelihood of obesity [50], diabetes mellitus [51],[52], hypertension [53] and chronic renal failure [54]. Chile presents consumption figures that justify an analysis from the public health perspective, in order to complement current strategies that address the obesity problem in the country. Currently Chile leads the world ranking of caloric intake for beverages, through a daily average sale of 188 kilocalories (kcal) per capita of sugary drinks, leaving behind countries with high consumption rates of these products, such as Mexico (158 kcal / daily) and the United States (157 kcal / day) [3]. Not only is the figure itself a cause for concern, but the significant upward trend it has presented over the past 30 years.

Given the multi-causality of this problem, the confrontation of this issue must come from multiple fronts. In Chile, health education and promotion activities, associated with clinical interventions, are carried out at the primary level of healthcare, mainly through the Healthy Life Program.

With regard to interventions through regulatory and control measures, there are ongoing updates to the Food Sanitary Regulation. Also recent changes have been made to current legislation, especially in the law on food composition and advertising and the increase to the additional tax to non-alcoholic beverages (IABA in Spanish). This tax represents 0.5% of the total national collection through taxes and an approximate 0.1% of the national gross domestic product [55].

Currently, food-specific taxes represent a topic of wide discussion and are being implemented in several countries of the world as fiscal policies to address obesity rates. These measures aim to generate incentives to modify certain patterns of consumption, in addition to correcting negative externalities associated with their intake. They are emerging as a complementary alternative to tackle obesity of the population in high prevalence countries. Within the group of food taxes, tax on sugary drinks stand out as a particular group, supported by numerous studies that suggest it as a promising fiscal policy, when applied in conjunction with other strategies.

Following the Chilean tax reform of 2014, the specific tax on sweetened non-alcoholic beverages increased from 13% to 18%. In addition, the tax on beverages with lower sugar content was reduced by 3%, being the only fiscal policy in force in our country to deal with the prevalence of obesity. While progress is recognized in this field, international experience suggests that the magnitude of the measure would be insufficient to generate impact on health [34],[56].

This summary is intended to give account of the recent international experience and evidence available on sugary drinks taxes, in order to inform decision-making processes in this area. The main tax alternatives implemented through modeling or local experiences are described. It also incorporates considerations on the political processes and implementation of a fiscal measure of this type, in order to provide a framework of information for further modifications that could be carried out in Chile. The methodological considerations of the evidence search, as well as summary tables of each study are detailed in the Annexes.

Evidence of effectiveness of fiscal policies on sugar-sweetened beverages

The effects of fiscal interventions can be divided into effects on prices, effects on demand, effects on consumption and effects on health outcomes. The following is a synthesis of evidence for each one of these effects:

1. Tax effects on price:

1.1 A pseudo-experimental study applied in Mexico showed a total pass-through of the consumer tax, with rises in prices similar to the projections. Even in urban areas, there was an overshift in prices of carbonated beverages greater than that given by the current tax [4].

1.2 Three studies implemented in the city of Berkeley, California [5],[6],[7], studied the pass- through of a one cent/ oz. tax, in force since November 2014. They concluded a lower than expected transfer to consumers, of 21.7%, 43.1% and 47%. An important limiting factor of the Berkeley experience was the application of a local tax in a small surface city. Tax evasion was easy by purchasing the product in a neighboring locality, with an elastic consumer demand given the geographical disposition [6],[7].

1.3 Other experiences showed a higher price pass through to the consumer than expected by the applied tax. In the second year of its application, a 4.5% tax on sweetened drinks in France generated a price increase of 8.1% of the product. The same experience was repeated in Hungary, where a 3.1% tax resulted in a price increase of 5.3% of sugary drinks [57]. (Table 1)

Full size

Full size 2. Tax effects on the demand for sugar-sweetened beverages:

2.1 The literature shows that consumers are sensitive to their demand for beverages in the presence of price changes. In the case of sugary drinks, the evidence consistently demonstrates that demand is elastic.

2.2 The literature search evidenced four studies in Latin America, which showed an elasticity of -1.37 for Chile [13], - 1.17 and -1.33 according to socioeconomic level for Ecuador [15], -1.06 a - 1.16 in Mexico [8] and -0.85 in Brazil [9] for sweetened beverages. Meanwhile, systematic reviews and meta-analyses reinforced these findings, with negative elasticities of -0.56 to 0.74 [10], -1.21 [11], -0.6 to -1.2 in medium-income countries [14] and -0.74 to -0.56 for Green [12], according to socio-economic group. (Table 2)

Full size

Full size 3. Tax effects on consumption:

3.1 An observational study applied in Mexican population accounted for the consumption of sweetened beverages and its change after the application of the Mexican one peso/liter tax (an approximate increase of 10% of the pretax value) in January 2014. An average decrease in consumption of sweetened beverages of 6% was observed. This reduction is accentuated during the last months observed, documenting a reduction of consumption of 12% for the month of December 2014. This decrease was higher in households with low socioeconomic status. In addition, there was a 4% increase in consumption of beverages without new taxes applied, mainly through increased consumption of bottled water [16].

3.2 Through a randomized controlled trial, Waterlander analyzed the potential effects of a 13% increase in sugary drinks tax in the Netherlands. Virtual supermarket software validated in previous studies was used for this purpose. The results showed a decrease in family purchases of 0.9 liters per week. In individual terms, there was a decrease of consumption of 400 ml weekly, with a calorie equivalent of 168 kcal less consumption per week. There were no significant variations in the purchase of other products from the supermarket [58].

3.3 Recent data emerging from the Berkeley experience showed a decline in sugar-sweetened beverage consumption of 21%, after tax implementation, compared to neighboring cities (without tax) where there was a 4% increase in consumption of those products [17]. There was also an increase in water consumption of 63% compared to other neighboring cities where consumption increased by 21%. (Table 3)

Full size

Full size 4. Tax effects on body weight:

4.1 We found 18 modeling studies [2],[18],[20],[21],[22],[23],[24],[25],[26],[27],[28],[29],[30],[31],[32],[33],[59] and three systematic reviews [34],[60],[61] who reported this aspect. The wide variety of scenarios, methods and information sources must be considered when interpreting the results.

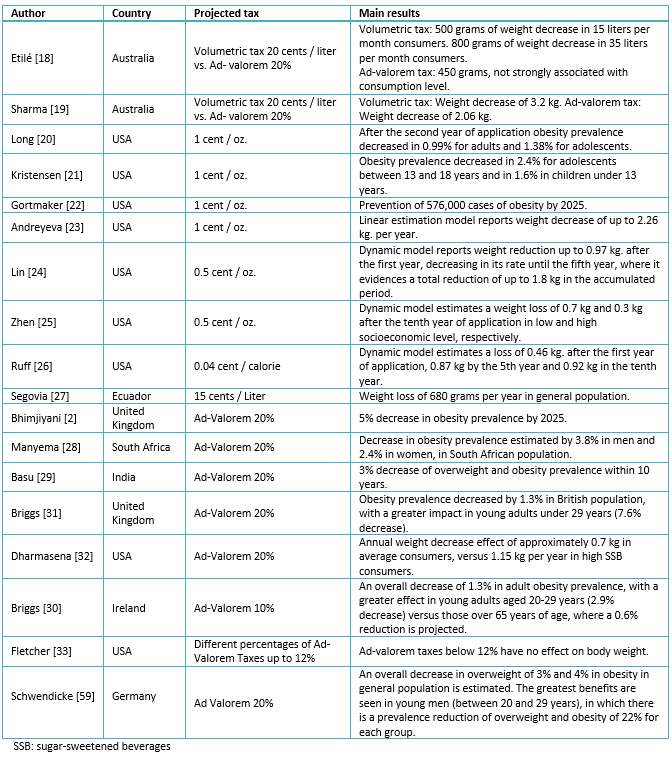

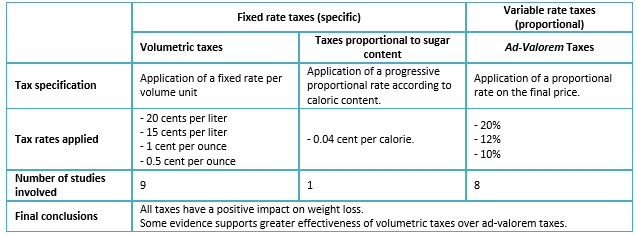

4.2 Three types of taxes were identified in studies: volumetric taxes on sugary drinks (one cent per ounce, for example), ad-valorem taxes, which consider taxing with a percentage of the final price (for example, 20% ad valorem tax) and taxes proportional to the sugar content (for example, one cent per gram of sugar). Modeling studies and their main results are detailed in Table 1. From the results, a greater relative effectiveness of a volumetric tax versus an ad-valorem tax to measure effects on weight loss, especially in high consumption populations may be remarked. Only one study estimated effects of a tax proportional to the sugar content (0.04 cent per calorie) [26]. (Tables 4 and 5)

Full size

Full size  Full size

Full size 4.3 Regarding specific volumetric taxes, most studies proposed a value of one cent of dollar per ounce (one liquid ounce = 29.5 cc) of sugar-sweetened drink. A positive association between this tax and reduction of obesity prevalence was observed, with projected decreases between 0.99% and 2.4% [18],[19],[20],[21]. Those figures were variable according to the year of measurement and the age group involved, with a projected prevention of 576,000 cases of obesity by 2025 in American population [22].

4.4 Estimations of weight loss varied among different studies, according to the methodology applied. Although all modeling studies included in this report documented some degree of positive impact on weight, the magnitude of this effect was dependent on the methodological approach adopted [24],[25]. Maniadakis et al., through a systematic review, highlight the limited evidence existing on body weight effects of food fiscal measures [61].

4.5 A modeling study carried out in Ecuador projected a volumetric tax of 15 cents per liter of sugar-sweetened beverages in Ecuadorian population, which indicated a weight loss of 680 grams per year in general population [27].

4.6 Six modeling studies and two systematic reviews concluded a potential effect on weight loss with an ad-valorem tax of 20% [2],[28],[29],[31],[32],[34],[59],[60]. Tax rates below 12% wouldn’t have positive impact on body weight. As an exception, Briggs showed that an implementation of an ad-valorem tax of 10% on Irish population would determine a decrease in body weight [30]. On the contrary, only one systematic review argues that although the consumption of a taxed food may decrease after being taxed, this reduction will have discrete effect in weight loss [61].

Acceptability and implementation considerations:

• Acceptability of the tax measure:

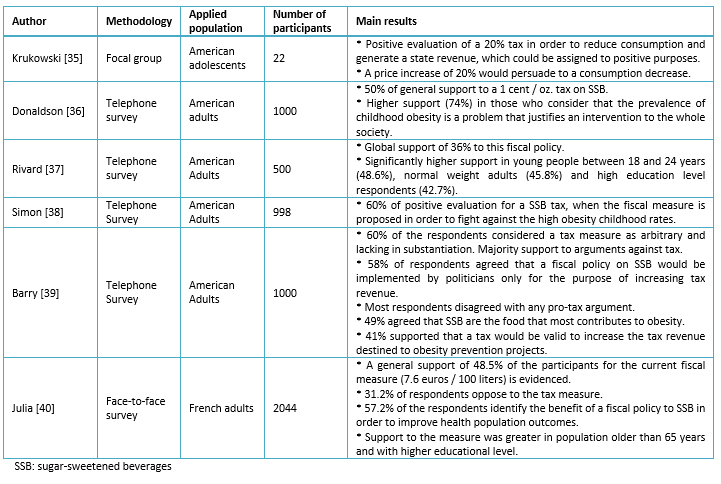

Regarding general consumer opinions related to a fiscal policy for sugar-sweetened beverages, this search reported various opinion studies, most of them representative of US population. Of all studies, five were applied in general population whose results are summarized in Table 6 [35],[36],[37],[38],[39],[40]. Different levels of acceptance were reported with a percentage of support varying between 36% and 60%. Those respondents with higher educational level and normal body mass index showed greater support to a fiscal measure applied to sugar-sweetened beverages.

Full size

Full size Niederdeppe et al. measured the media impact of a tax proposal, through the evaluation of the American written press. They emphasized a higher percentage of news with messages that support this measure (83%), under arguments of health benefits and tax collection. Within the messages against this policy, the negative implications in economy and an inadequate governmental intrusion were distinguished [43].

An interview to 18 key stakeholders with experience in fiscal measures was conducted in order to assess the impact and effectiveness of messages against and in favor of sugar-sweetened beverages taxes. Messages in favor of the measure with greater identification by the interviewees were associated to the negative health externalities of excessive consumption of sugary drinks (obesity and diabetes) and the social benefits of the investment of the tax collection. Messages against the measure with greater identification were related to a potential negative economic impact of the policy, through the loss of jobs and the government's authority to intervene in personal liberties [41].

Another small group, made up of 12 Australian citizens, was exposed to vast information provided by experts and deliberation regarding the subject of sugary drinks taxes. There was unanimous support for a fiscal measure on sugary drinks, in conjunction with nutritional labeling measures to address the problem of obesity, especially in children [42].

• Political process, design, implementation and other considerations:

A qualitative research carried out in 2015 was intended to explore the political context in addition to the objectives, arguments, and tactics employed by supporters and opponents of the 5% tax increase on sugar-sweetened beverages implemented in Chile, as part of the tax reform of President Bachelet. Supporters of this measure used as an argument the high prevalence of national obesity, along with international evidence on fiscal measures to address this problem and the dissemination of information through validated voices from civil society and academia. The lack of local effectiveness studies to support the policy was argued by its detractors as an important argument against this measure. In addition, the need for a global approach to tackling the obesity problem in all its aspects was identified, using consolidated and strategic alliances among different actors in order to generate eventual fiscal policies of further assertion in the future [44].

On the other hand, a work carried out by Chriqui et al. in 2013 showed the main aspects that must be taken into account when designing and implementing a fiscal policy for sugar-sweetened beverages:

i) Type of tax, its application and mode of collection.

ii) Types soft drinks taxed.

iii) Applied rate.

As a corollary, they suggested that countries with intentions to implement these types of taxes should aim at designing a policy that generates the highest possible price increase, as well as encouraging the consumption of other healthy alternatives, such as bottled water, in the case of sugar-sweetened beverages [46].

Complementary to the previous point, Jou and Techakehakij analyze the local considerations of a fiscal policy of this nature. In their analysis, they conclude about three key aspects to be taken into account for a successful implementation: local prevalence of obesity; local sugar consumption figures; and the existence of a similar tax in force. The authors emphasize in their conclusions the importance of knowing in depth the local reality, in terms of consumption patterns, substitution and political support for this type of measures [45].

Min performed an analysis of the context and implications of the restriction project on the sale of sugar-sweetened beverages in New York City. Prior to its implementation, this restriction measure was aborted by judicial order, for being considered unconstitutional (by violation of personal liberties) and lacking theoretical support. Regarding the difficulties that may arise in the implementation of a sugar-sweetened tax, Min identified the lobby made by the industry associated to a possible unpopularity of a tax due to high general consumption rates. In addition, when comparing a sugar-sweetened beverages tax with other fiscal measures applied to tobacco, there is less awareness of the harmful effects and potential addiction that sweetened beverages can cause, which would limit the acceptability of such measure [62].

A modeling study performed by Briggs et al. [63] examined the potential responses of the UK sugar-sweetened beverage industry to a tax on these products. Three alternatives were analyzed: reformulation of the product with reduction of the sugar content, increase of its price and change in the market offers with introduction of similar products with lower sugar content. Given these three scenarios, the impact on health was modeled, evidencing a positive response through a decrease in the obesity prevalence by approximately 0.6%, independent of the response adopted by the industry.

• Equity considerations: A regressive tax is one that has a greater impact on the poorest people, who allocate a bigger proportion of their income to its payment, than those with higher incomes. Because lower-income households assign larger proportions of their budget to food, [64] the possible regressivity of a tax of this nature has been raised [65]. However, the evidence showed that a sugar-sweetened beverage tax would have a greater impact on health of lower socioeconomic groups, due to its greater elasticity in demand associated with prices, resulting in a greater decrease in consumption [8],[9],[10],[12],[14],[15],[16]. Also, it should be considered that obesity prevalence in Chile is higher in low socioeconomic groups, potentially receiving the highest health benefits. Finally, considering that the expenditure of tax collection is progressive, the net effects of the measure are likely to be neutral or progressive.

• Potential negative effects:

Employments: in order to measure a potential impact on population employment, Powell simulated a 20% sugar-sweetened beverages tax in the states of Illinois and California by 2012. An increase of employment figures on both states, of 0.06% and 0.03% respectively, was evidenced. Although a diminution in employability was detected in the beverage industry, this reduction was offset by the creation of other jobs in government sectors and other industries. The author noted that it is important to take into consideration that even in the absence of sugar-sweetened beverages taxes, US data stated that employability in this industry has decreased by 30% in the period 1992-2007 [47].

Substitution: the study results reported an overall decrease in the daily purchase of sugar-sweetened beverages of 24.3 kcal per person, which reflected into a weight loss of 0.7 kg in the first year and 1.3 kg. in long-term. Associated with this tax, fruit juices sales would increase, contributing with additional 2.5 kcal to the daily purchase. There was no evidence of substitution to other sugary foods (cookies and sweets) and there was also a decrease in the purchase of other complementary products, such as salty snacks [48].

Conclusions

The research yielded valuable information to consider in the decision-making process of a fiscal policy applied to sugar-sweetened beverages. Findings regarding the demand for taxed sugar-sweetened beverages are consistent with previous reports in the literature of persistently negative elasticities. This reflects that the consumption of this type of products is sensitive to the selling price, both in modeling studies and in local experiences, concordant with the economic rationality that support these measures. In relation to the post-tax prices, a study in Mexican population reported a 100% pass-through of the tax to the final consumer, also consistent with the available evidence [4]. As previously described, In the case of the Berkeley experience, geographic considerations of the locality may explain the findings of this study, with less pass-through to consumers.

With regard to studies associated with consumption, a pseudo-experimental study applied by Colchero et al. [16] in Mexican population evidenced a significant decrease in sugar-sweetened beverages consumption when a tax of one Mexican peso per liter (approximate an increase of 10% of the price) was applied, reaching a 17% reduction in low socioeconomic groups. It is relevant to emphasize the importance of analyzing the Mexican experience in order to learn lessons that may be applicable in Chile, due to the fact that both countries present similar obesity figures, associated with high consumption rates of sugar-sweetened beverages.

Due to the difficulties in carrying out long-term follow-up studies that evaluated the impact of the tax on body weight, the evaluated investigations corresponded mostly to modeling studies. Given the different fiscal alternatives, there is a greater effectiveness of volumetric taxes versus ad valorem taxes in reducing body weight. Volumetric taxes would have the capacity to decrease consumption in entire population, but especially in high consumers, who would have a higher prevalence or risk of obesity [18].

Regardless of the type of tax applied, evidence shows that a price increase of 20% of the product taxed is optimal to generate health impact, although those increases between 10-20% would also have positive effects. Tax reform in Chile, in force since 2014, generated a price increase in sugar-sweetened beverages of 5%. Although this measure was raised for collection rather than health purposes, the findings of this research, in accordance with previously available evidence, indicate that price increases lower than 10% are less likely to generate positive impacts on health outcomes.

With the application of a tax on sugar-sweetened beverages, multiple considerations arise regarding the implementation of this measure. General population opinion related to these taxes is diverse, although it is mostly positive by normal weight people of high socioeconomic levels and when the argument of high rates of childhood obesity is used for its enforcement. Apparently, population information and education about this type of measures is a key factor to consider in any implementation process. It is necessary to publicize the national obesity prevalence problem, the high rates of sugary drinks consumption and the nature of a fiscal policy to complement the approach of this problem in the country. The industry opinion is more critical, mainly because of the negative effects of a tax measure of this type on the economy, in relation to the potential decrease in employment rates. The opinion of actors involved in health policy decision-making processes, particularly industry, is more critical than opinion of general population. They argue mainly for the negative effects on the economy of a tax measure of this type, in relation to the potential decrease of jobs. Apprehensions associated with employability are recurrent, although evidence suggests that the effect is marginal, so it will be important to address them in the policy information process.

With regard to the qualitative research that studied the current political context in Chile [44] in view of the sugar tax increases included in the last tax reform, it is possible to emphasize positively the inclusion of the topic of obesity and sugar-sweetened beverages in the legislative agenda. Although, as mentioned above, the purpose of this reform was mainly collection and the increase of the rate was discreet, the tax modification implemented allowed to place this subject in the public agenda, generating opinions of both supporters and opponents of the measure. The investigation revealed important difficulties in the decision-making process, mainly due to the absence of national evidence regarding the issue. This aspect should be taken into consideration in case of proposing new increases to the current tax.

The findings of the literature search indicate that fiscal policies on sugar-sweetened beverages to deal with high obesity rates are current strategies that have attracted important attention worldwide, with positive evidence of their effectiveness. Chile presents important obesity statistics, associated with a high consumption pattern of sugary drinks that position it as a country that could potentially benefit from the implementation of a tax measure. Although the evidence is broad, more studies of higher quality are still needed, which will allow us to project the impact of the application for health purposes of a sugar-sweetened tax in Chile. Through this search, it was evidenced that this is a topic of great interest in countries with high prevalence of obesity. In addition, it should be emphasized that the evidence supporting its application is increasing. While recognizing the need to increase the available evidence in Chilean population, the findings of the international literature available, allow us to advance in the discussion of possible courses of action.

Food tax measures to address obesity problems in population are viable and promising alternatives that should be considered as part of a comprehensive strategy to approach this complex and multifactorial problem. No strategy, by itself, can give an effective response to the health problem associated with the high prevalence of obesity. Over the last decades, Chile has presented multiple measures to deal with national obesity statistics, however its prevalence still maintains a rising tendency. In this respect, it would be interesting to study and plan the application of a fiscal policy to sugar-sweetened beverages in Chile with a health perspective, in order to successfully expand the fronts to fight against national obesity prevalence.

Annex

Methodology

In March 2017 a bibliographic search was made in Pubmed, Epistemonikos, Health Systems Evidence, Cochrane and Google Scholar, The terms "Sugar sweetened beverages", "Soda", "Obesity" and "Tax" were used and the search was limited from May 2011 to March 2017, resulting in 123 different publications.

From all the publications, the following types of studies that evaluated tax interventions to sugar-sweetened beverages in general population were included: systematic reviews, randomized controlled studies, modeling or simulation studies, pseudo-experimental, observational and qualitative studies. Those studies that measured outcomes related with the effects of sugar-sweetened beverages taxes in price, demand and consumption of sweetened beverages, in addition to the impact on body weight, were evaluated. The analyzed studies also included those that provided information about stakeholders’ opinions and other aspects associated with the political process, design and implementation of the fiscal measure.

In order to focus the research, only those modeling studies that measured impact of the fiscal intervention on body weight or body mass index were included. We excluded studies focused on other health outcomes.

With regard to the literature on policy processes, design and implementation, evidence from expert opinions and local experiences of implementation was also taken into account. In addition, it was supplemented by manual citation searches and a targeted search in gray literature concerning national experience on fiscal policies for sugary beverages.

Previous considerations determined a total of 54 publications for analysis. GRADE guidelines [66] were used to evaluate the quality of evidence of certain studies in consideration of their methodology.

Notes

From the editor

The authors originally submitted this article in Spanish and subsequently translated it into English. The Journal has not copyedited this version.

Declaration of conflicts of interest

The authors declare that they have no conflict of interest and declare that they have not received funding for the preparation of the report; have no financial relationships with organizations that might have an interest in the published article in the last three years; and have no other relationships or activities that could influence the published article.

Financing

The authors state that there were no external sources of funding.